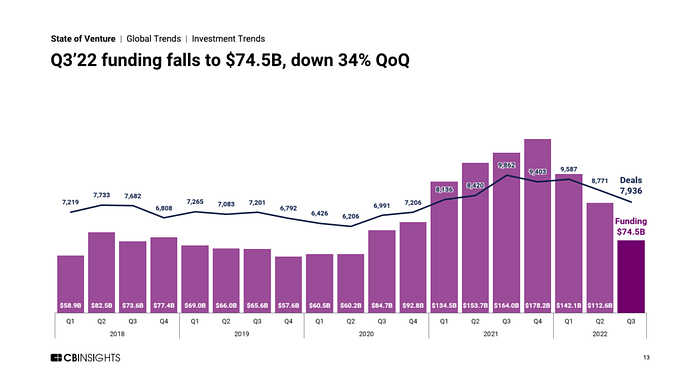

This year in Venture Capital was a tale of two halves. For some perspective PORTAL’s very own Managing Partner and 20-year VC veteran, Peter Loukianoff, shares his biggest takeaways. “The first half of 2022 was gleaming with valuations high and projections even higher paired with a booming crypto and NFT market. VC fundraising was on a record pace with $150.9 billion raised across 593 funds in the first three quarters of 2022. But, by summer the tide started to turn and we saw startups lowering valuations and raising more cash in anticipation of a difficult 2023,” he shared.

“By the fall, higher inflation, rising interest rates, and the collapse of FTX had affected the IPO market with the number of offerings down 45% and the number of proceeds down 61% year-over-year. Loukianoff added, “the unfavorable IPO environment in Q4 put increasing pressure on later-stage valuations, which trickled down to early-stage companies.”

IPO Domino Effect

The public market affects startups more than people may think. “When IPOs slow down, later stage investors who were betting on receiving liquidity in a few years with 3x+ multiples on their investments are now having to wait longer, which reduces their internal rate of return (IRR),” said Loukianoff. “That immediately starts to affect late-stage prices, which consequently results in lower mid and early-stage valuations.”

The ‘Right’ Valuation

“It’s important for early-stage entrepreneurs to value their companies at the ‘right price,’ not necessarily the ‘highest price,” Loukianoff emphasized. “Early-stage investors need to see a significant step-up in valuation at the next round (in 12–18 months) to get paid for their risk. Otherwise, they just won’t invest. Over-pricing could also trigger anti-dilution provisions in future rounds, which could have other messy consequences.”

One of PORTAL’s savvier entrepreneurs anticipated that 2023 is going to be a tough year. His company is doing very well financially, but this experienced founder decided to accept a lower valuation in Q3 2022 in favor of raising more cash to increase his company’s runway. Since his previous round was ‘priced right,’ he was able to accept this lower valuation while still providing his previous investors with a decent step up in this round. He wisely understood early on that having the ‘right valuation’ vs. the ‘highest valuation’ would provide him something valuable — the room to maneuver and raise capital even in tough environments like today. Had he overpriced the prior round, he would have had his existing investors facing a down round and unhappy employees experiencing more dilution.”

Loukianoff advises founders to engineer steady increases in valuation through venture financing rounds rather than steep jumps, because it makes it harder in times like these to reach escape velocity. There will always be economic downturns whether it’s every 5 to 10 or 15 years, and entrepreneurs need to be prepared for moments like these. If a startup’s capital base is designed correctly, entrepreneurs and investors will be rewarded with higher valuations at the IPO when the steepness of a company’s growth curve will be the key to its success.

Observations

The last decade has been characterized by bloated valuations that were not necessarily justified by fundamentals. Startup valuations are now receding as a worsening recession looms. But as Loukianoff experienced in two prior economic downturns as a venture capitalist, this recession feels a bit different.

“Firstly, since there were only seven years between the 2001 dot-com bubble to the Great Recession of 2008 there was less time for company valuations to become inflated. In this recent run, we have had 14 years of relatively good times (2008 to 2022). Consequently, many more startup founders and executives had never experienced a recession, and thus expectations may be more unrealistic this time around.” Loukianoff explained.

Secondly, he shared that the 2008 recession was an extreme shock to the system, “With monumental events like the Madoff investment fraud scandal (the largest in US history), and the collapse of two venerable Wall Street firms, Lehman Brothers and Bear Stearns. It was ‘nuclear winter’ for VC financings, and valuations were affected by inactivity due to high uncertainty as much as anything else. It seems to me that 2008 was more about microeconomic issues that affected the macroclimate. But with the current recession, it seems in reverse; with macroeconomic problems (monetary and fiscal policies, geopolitics, etc.) trickling down to the micro level.”

Thirdly, venture capital assets have now passed $2 trillion for the first time — more than double the size in 2008. “While VC firms have increased AUM (assets under management), many are unable to adequately serve seed and early-stage companies. The most common frustrations we hear from founders is that institutional VCs tend to over-capitalize startups, are not very helpful, and are just ‘making bets’ in early stage deals in hopes of putting more money to work in later rounds. This behavior is a direct result of too much capital in the VC asset class.”

In short, Loukianoff said, “due to these factors, I don’t think this recession will be as extreme as the last one, but it may be more prolonged. However, we’re already seeing startups getting back to basics and focusing more on clear value propositions, unit economics, and measurable progress.

A Wrap on 2022 and a Look Ahead

While 2022 marked the beginning of a recession, this correction is needed and ultimately healthy for the venture capital market. As in prior downturns, this period will be a good time to invest in growing early-stage startups with more reasonable valuations.” And, with abundant capital available for later rounds, there is arguably less financing risk.

Following the Great Recession, which lasted 19 months starting in December 2007, the number of tech IPOs during 2008–2011 grew from six (2008) to 14 (2009) to 33 (2010) to 36 (2011). IPOs were firmly back in 2011 with companies going public like LinkedIn, Zynga, Pandora, Homeaway, Elle Mae, and Yandex. If history is a guide, we will see a return to startup fundamentals in 2023 with early-stage VC investments poised for attractive returns in the future.